Thursday, June 7, 2018

CryptoYONEX: SKYFCHAIN – First Business-to-Robots (B2R) Operati...

CryptoYONEX: SKYFCHAIN – First Business-to-Robots (B2R) Operati...: The SKYFchainOperatingPlatform willprovide a disruptive solution forswitchingglobal logistics industriesto unmanned systems.As an i...

SKYFCHAIN – First Business-to-Robots (B2R) Operations Based on Blockchain Technology

EXECUTIVE SUMMARY

Unmanned cargo robots in the air, on the ground and at the sea can dramatically reduce cost of logistics worldwide and increase efficiency forindustrialusers andend customers.

While PwChave estimatedaddressable market size for airborne dronesaloneto be $127 bn.1, the current industry limitations includinglack of stable credit, costly insurance and near-prohibitive regulations in some countriesdo not allow it torealizeits full potential. Currently, this industry exists in form of feasibility studies carried out by large corporations or startups.

Universal operating platform for the cargo robots doesnot exist. SKYFchainOperatingPlatform(hereinafter SKYFchain OP)is thefirst B2R(business-to-robots)blockchain based operatingplatform applicable globally inall sectors of a developing cargo roboticsindustry. It will be initially developed and tested by using the first industrial cargo airborne robot –SKYFdrone –which will also give SKYFchain instant access to its client base for development of unmanned business processes.Later all other unmanned cargo systems: in the air, on the ground and at the seawill be connectedto SKYFchain.

The first feedback from our customers in oil and gas industry confirms that if they switch from helicopters to cargo dronesthey can supply their on-shore rigs with 5 to 10 times less cost.SKYFchainas ablockchainwith built-insmart contracts will providetrusted source of data and reasonable control over unmanned assets for clients, logistics operators, insurance and leasing companies, banks,andauthorities worldwide.

It will unveil new profitable business opportunitiesfor all industry participants, transportation systemwith lower risk for the society, and increasedoverall affordability of goods and services due to substantial cost cutting in the global supply chain.

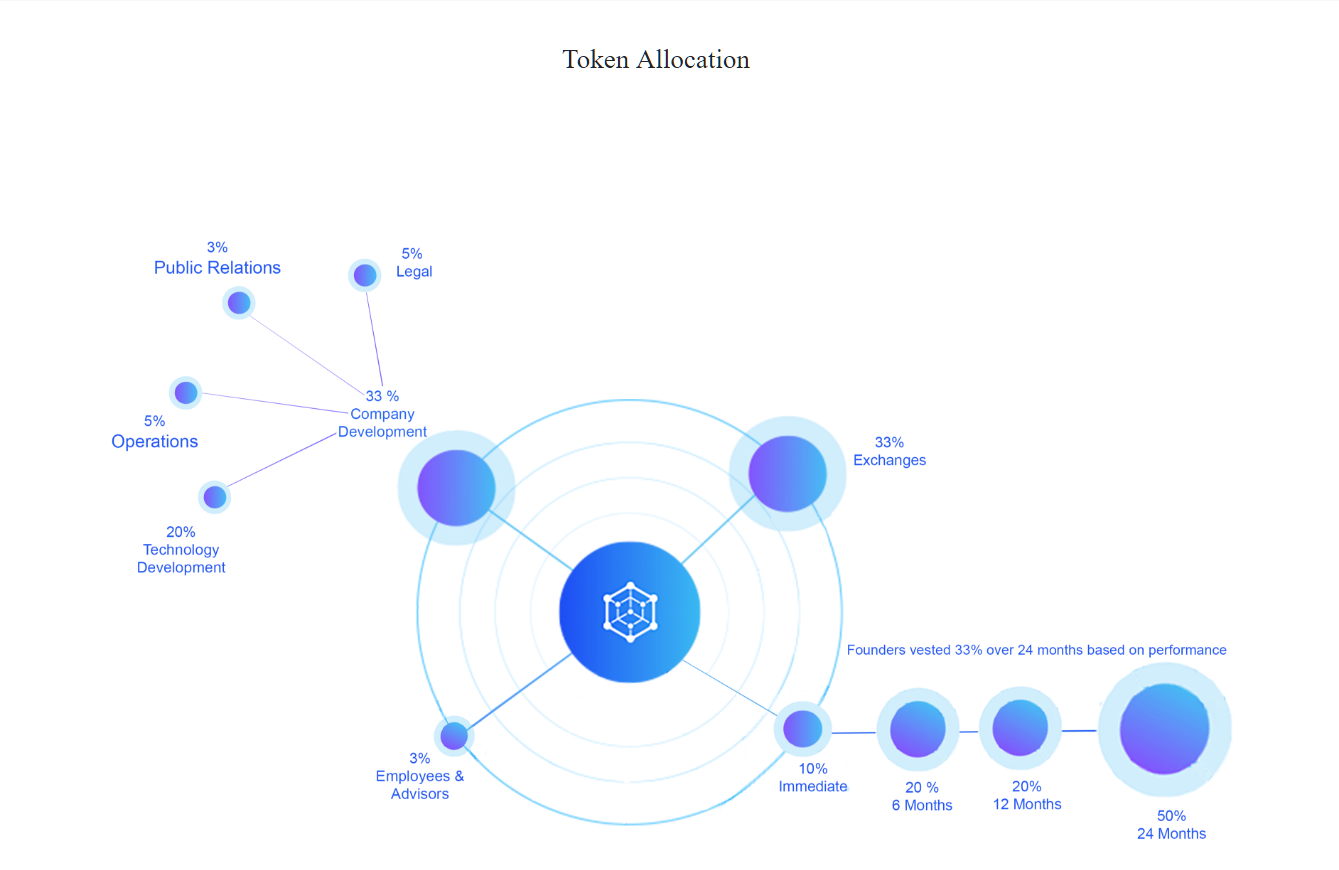

During ICO we will issue 1200000000 SKYFT tokens,which will be used in SKYFchain to facilitate all internal transactions.

We expect that value of SKYFT mayincrease over time because of two main drivers:1.More and more companies, clients, financial institutions will be connected to SKYFchain which will drive the growth of transactionsin SKYFchain and demand onSKYFT.2.For every SKYFchain transaction whether it’s getting loan to buy unmanned vehicle, client payment or something else SKYFchain will charge some commission. 25%of commissions will go to SKYFT holders.

We expect that value of SKYFT mayincrease over time because of two main drivers:

- More and more companies, clients, financial institutions will be connected to SKYFchain which will drive the growth of transactionsin SKYFchain and demand onSKYFT.

- For every SKYFchain transaction whether it’s getting loan to buy unmanned vehicle, client payment or something else SKYFchain will charge some commission. 25%of commissions will go to SKYFT holders.

We understand that your backing of SKYFchainmay be associated with riskand we have takenseveral measures to mitigate those risks:

- SKYFchain legal entity -Skyfdrones Services OU -is registered in Estonia which has one of most favorable regulationsin the worldfor blockchainrelated companies.

- SKYFTtokens are compliantwith SEC of USA and available for US investors.

- Hundreds of SKYF drones will use SKYFchain as an operating platform. SKYFchain developers will have direct access to all SKYF drone clients to test and polish SKYFchain system before inviting otherproducers of dronesto use the system.

- SKYFchain is aspin-off of SKYFdronedevelopment project, which in addition to granting SKYFchain access to clients shall use 20% of revenues from sales of SKYF drones to purchase the SKYFT tokens from the market. We estimate that this may amount to$50M during the next 3-5 years after the ICO. And the SKYF drone is designed with full range of IP protection measures including patens and know-how. Thisshallprotect SKYFchain uniquenessfor the time of its initial development.

- SKYFchain has very experienced and trusted team of engineers and business leaders with proven results–they have attracted $5M of VC money into the SKYF drone project.

SKYFchain OP business model

Logistics business processes today are designed with a human being in mind, eitheras acustomeror acontroller etc.

Autopilots for cargo robots, AI and the developing field of IOT hints that one day,robots may work without being directlycontrolledbyan individual.

This would bring enormous savings since currently,around 50% of costs in logistics is in labor. The field in cargo roboticswill require investments, and investmentsneed insurance, risk management and control. Thus,unmanned cargo robotsmay become an asset which would require new types of regulations and business processes. We are planning to develop them in the SKYFchain Operating Platform.p

The main purpose of the SKYFchain OPis to integrate information for all market participants and organize the execution of smart-contracts for transactions.Transactionsmay vary in value and frequency. The platform will collect commissions from each transaction.All transactions will be paid inUSDor other fiat currencybut executed in systemusingthe SKYFT tokens.

SKYFT token will be the internal currency of the platform. Only 1.2 bntokens will be issued at ICO in form of Ethereum ERC20 tokens.This is fixed amount for all system

We are going to test the platform using SKYF drones, then we shall educate drone producers and integrateother drones into the system. When sea-borne and ground-borne cargo robots come into the market, we shall integratethem as wellby organizing workshops with respective associations of producers.

As the number ofcargo robots connected to systemgrows, so does the number of transactions.More tokens will be needed to execute the smart-contracts and the SKYFT exchange rate may increase.We expect that theclients would usually pay us in fiat and crypto currencies, and purchase our tokens from thecrypto exchangesin case of need. We are planning that SKYFT tokens will be traded at least at four or five crypto exchanges.Thiswouldcreateliquidityneededfortheplatformoperations.

For a tokenbuyer at ICO,the downside protectionis the fact thatSKYFchain OPwill becreated using three unique resources:

1. The exclusivity ofservicingoperationsof SKYF drone-the world’s first heavy and industrial grade cargo drone. It is a fundamentally new drone vehiclewith a hybrid gasoline-fueled engine that outperforms existing drone solutions. It is capable of vertical take-off and landing, and has an ultra-high useful load of up to 400 kg/880lband an exceptional flying range of up to 350km/220 miles. The SKYF drone suits multiple market segments, including logistics, agriculture and firefighting to name a few.It’s already have clients which would allow SKYFchain to develop new business processes of unmanned logistics.Those clients willalso bring in transactions to executeon SKYFchain.SKYF drone IP and know-how fully protected

2. 20% of the revenue fromsales of thefirst 1000 SKYF drones will bereserved by a license agreementwith the SKYF drone producers topurchaseback SKYFT tokensfrom the market.

We expect this to take placeduring the first three to fiveyears after ICO (this revenue isequivalent to $50-60mln).Tokens bought under this condition will be put into a Community Development Fundand used to reward partners and developers of the SKYFchain

3. Mission planning, verification and operations support of SKYF drones (and later other drones) will be run through SKYFchain –a unique private blockchain:

- SKYFchainsuper nodeholders willreceive50% of transaction fees.

- SKYF drones will be marketed together with a franchise of a drone logistics operator and a license for the third-party drone producersof drones and spare parts. By 2021, more than 1100 SKYF dronesprojected tobe operating worldwide, andother drone manufacturers and owners will also be able to join the SKYFchain OperatingPlatformthereforeincreasing the number of transactions in the system.

The upside for atokenbuyeris our plan to open the SKYFchain OPafter the testing periodfor all other developers and manufacturersof air-borne, sea-borne and ground-borne cargo robots.The SKYF dronewill become just one of the many participants of the platform.

SKYFchain OP key metrics(conservative scenario

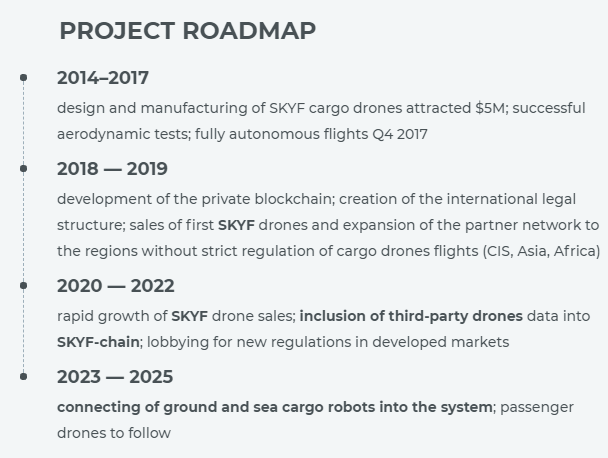

Project roadmap

SKYFT Token Sale

- Presale ($2 M) was reached just in 5 days

- The main sale is on from March 10

- Only 51 300 000 SKYFT tokens is reserved for Pre-ICO

- Minimum tokens purchase volume is 3000 SKYFT

- The ICO-end price will be 0,065 USD per 1 SKYFT

- SKYFT is compliant with USA’s SEC and available for US investors

- ERC20 Token Standard

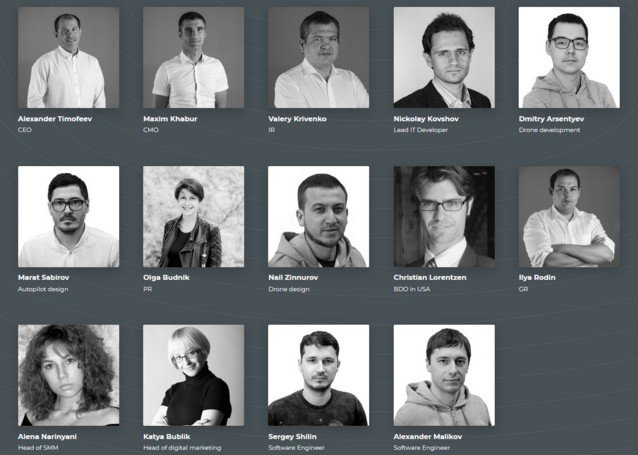

TEAM

MORE INFORMATION :

Impressio Estate

Impressio Estate, Ltd, is a UK-based cryptocurrency investment platform for users worldwide to invest

and grow their money, whether it is deposited all at once or incrementally. We offer unique investment plans

for investors of all kinds. There are many people that do not know how to begin investing in cryptocurrency, or

simply do not have the time and/or energy to do so. Impressio handles all of these needs for them, and goes

above and beyond for their investors.

In a recent Forbes article, a survey by Blockchain Capital pointed out that 30% of those aged 18-34 would

rather invest $1000 into bitcoin or cryptocurrency rather than government bonds or stocks. If one takes these

growing numbers in conjunction with the money that has been flowing into the cryptocurrency markets over the

past few years, and bound to enter the markets in 2018 and beyond - it is clear that a pivotal shift is occurring.

Every once in a while, there are paradigm shifts, and we are on the brink of one.

Impressio currently is focused on investing opportunities, but is proud to enter the lending sector in 2019.

There is truly some untapped potential when it comes to the efficiency and transparency of blockchain, and

Impressio hopes to maximize the opportunities in both the investment and lending sectors. This allows

Impressio to be in a unique position to benefit from both investing and lending.

In early 2017, Josh Price and Evan White had come up with the idea for an ICO project for private investors.

As time progressed, they realized that perhaps there was an opportunity for the public to participate in, as well.

The private investors provided a way for more investors to participate in the profits by investing, as Impressio

was in a position to earn money through commissions.

Impressio is confident that the cryptocurrency market will see a tremendous amount of growth in the coming

years. The human race is always quick to adopt technology that makes life easier and more efficient, and

blockchain shows us how money can be transferred in a new revolutionary way. This is obviously one of the

main reasons behind bitcoin’s meteoric rise over the past few years, which is exponential, especially

considering how it compares to stock exchanges across the world. This has created a massive amount of new

wealth, not to mention drawn tremendous interest worldwide to the potential of cryptocurrencies, and the

various sectors that they could aid in.

The beauty of Impressio is that it is diversified. Of course, it is an obvious choice for those who are interested

in investing in cryptocurrency without the time or energy to commit to the market constantly. However, the

private investors involved with the company add a new additional layer of leverage that makes the company

uniquely positioned to maneuver throughout the coming years. The token sale will lead to more revenue, and

of course, the lending platform will allow for a whole new source of revenue, and attract a whole new

demographic of interested parties.

BACKGROUND

However, one thing has become certain: the banking sector is becoming increasingly unreliable.

The truth is that, on some level, there has always been corruption in the financial sector. However, in

modern times, it is safe to say that the greed that has always plagued the banking system has spiraled out of

control. There are global banks that have been looking the other way when it comes to criminal activity,

whether it is protecting politicians or even large international cartels. This is the same kind of willful ignorance

that led to the subprime mortgage crisis in 2008 that led to a United States recession, that eventually affected

the global economy. More people than ever realize today that the banking system was not an innocent

passerby or victim in these crises, but actually an active participant

Now, to many - this simply isn’t that important. You might say, “I understand, but at the end of the day,

I trust the banks,” or, “I don’t mind if my financial advisor is greedy, as long as he is making my money or at

least keeping my money safe!” However, the issue is that the banking system is constantly bailed out. In the

United States, for example, the banks were literally bailed out by the government. There are countless other

examples in countries across the world where governments realize that banks are necessary for survival, and

extend them loans or prop them up somehow.

MORE INFORMATION :

| web | Whitepaper | Twitter | Facebook | Telegram |

Monday, June 4, 2018

Blüpass - is an Ethereum based token

Blüpass is an Ethereum based token that enables multiple users to access our platform designed to better connect

providers, carriers, and consumers. Our platform will put control in the consumers hands to facilitate data

transfers between providers and carriers for electronic health records, claims service, policy and premium

verification, and much more. We believe our blockchain technology supported with smart contracts will

dramatically change the insurance and delivery of healthcare.

Blüpass will revolutionize access to data, healthcare, and the claims process for everyone. We

began our experience by administering benefits in a unique way. Our billing reconciliation

process, HRaspirin, eliminated headaches between HR professionals and carriers. We spent six

years in this space developing strong relationships. As good as our product was, it only solved

for one side of a broken equation. This prompted us to create Blüpass, a total solution.

Blüpass will build a blockchain fabric to connect providers, consumers, and carriers. Historically,

there are three major problems in the healthcare arena. First, healthcare providers must spend

a significant portion of their time and revenue on billing, health records, and treatment

modalities. The provider may not have a complete picture of the consumer’s financial

responsibility or health record. Second, carriers attempt to limit potential fraud through a

lengthy and manual claims process. This process can take up to 6 months in the current

environment to pay claims. Third, consumers are caught in this vortex of uncertainty between

providers and carriers. This turbulence places unnecessary burdens on consumers in the form

of expenses and treatment delays. Blüpass will build a multilayer blockchain to accommodate

existing and new healthcare technologies. We will utilize our unique blockchain ledgers to

deliver instant data for claims service while providing technical support to eliminate fraud for

carriers. Finally, we will build a client centric mobile platform that enables consumers to control

the timing and delivery of medical records and application of claims. Simply put, we believe

consumers should have instant verification of their policy information and claims adjudication

at the point of service. Additionally, a simplified financing system in the U.S. could result in cost

savings exceeding $350 billion annually, nearly 15% of health care spending. Imagine any other

experience in which you buy a service and the provider can’t tell you how much it's going to

cost up front and you are expected to pay whatever bill they send you 6 months later. When

you buy insurance against this uncertainty, the carrier demands to be paid on time without

exception but can't offer claims service at time of service. Blüpass solves for these

inconsistencies.

Executive Summary

Unique to the ICO world is a real company with real products and solutions. Blüpass is a

product born from innovation as we have solved reconciliation headaches for over six years.

Blüpass will change everything that is deficient in the Healthcare industry and transform it into

a consumer centric, egalitarian model. For many years, carriers and providers have worked

tirelessly to reduce overhead due to fraud and problematic HIPAA Privacy and Security

regulations in regards to billing and electronic medical records, all at the detriment to the

consumer claim process and data ownership. By utilizing Blockchain technology to build our

platform, we will transform the way data flows between each simultaneously. We will solve all

three client components at once. Blüpass is a consumer driven platform that solves claims

processing delays, provider overhead, and carrier claims fraud. Insurance claim inaccuracies

alone costs patients and providers up to $600-800 billion annually. Blüpass benefits from the

existing payment structure, HRaspirin. Our payment reconciliation system allows for various

groups, businesses, associations, unions, or individuals to establish traditional individual groups

or group platform benefits and eliminate human resource administration of the benefits plan.

We collect premiums, reconcile invoices automatically, monitor individuals for missed

premiums, and consolidate multiple carrier invoices with our proprietary software. We will use

Blüpass blockchain ledgers to verify premiums instantly against policy information to enable

guarantees on claims. HRaspirin’s success positions Blüpass with enormous options for positive

growth from day one. Blüpass will enhance HRaspirin’s client experience via instant

verification of consumer premiums, policy provisions, and providers universal coding to enable

settlement of specified provisions at the time of service.

Overview of Healthcare Market

Healthcare providers are often torn between the desire to serve their community and

maintain the finances of a tormented business model. Administrative stresses and

pressures force providers to compensate with ever rising price structures.

The United States’ multiple-payer health care system requires substantial

effort and costs for administration, with billing and insurance-related

(BIR) activities comprising a large but incompletely characterized

proportion. A number of studies have quantified BIR costs for specific

health care sectors, using micro-costing techniques. However, variation in

the types of payers, providers, and BIR activities across studies

complicates estimation of system-wide costs. Using a consistent and

comprehensive definition of BIR (including both public and private

payers, all providers, and all types of BIR activities), we synthesized and

updated available micro-costing evidence in order to estimate total and

added BIR costs for the U.S. healthcare system in 2012. BIR costs in the

U.S. healthcare system totaled approximately $471 ($330 – $597) billion

in 2012. This includes $70 ($54 – $76) billion in physician practices, $74

($58 – $94) billion in hospitals, an estimated $94 ($47 – $141) billion in

settings providing other health services and supplies, $198 ($154 – $233)

billion in private insurers, and $35 ($17 – $52) billion in public insurers.

Compared to simplified financing, $375 ($254 – $507) billion, or 80%,

represents the added BIR costs of the current multi-payer system.

(https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4283267/)

Administrative costs in the United States consumed an estimated $156

billion in 2007, with projections to reach $315 billion by 2018 (Collins et

al., 2009). With the time, costs, and personnel necessary to process

billing and insurance-related (BIR) activities from contracting to payment

validation on the provider side and the needs of payers to process claims

and credential providers, significant redundancy and inefficiency arises

from healthcare administration. Adding to concerns is emerging evidence

of an inverse relationship between administrative complexity and quality

of care (Himmelstein and Woolhandler, 2002). The presenters in this

session approach estimating excess administrative costs from a variety of

macro- and microeconomic levels, all with the goal of identifying the

portion of expenditures spent on administration that could be reduced by increasing the efficiency of the delivery system, which highlights the need

for administrative simplification and harmonization.

Payment Collection

HRaspirin currently solves for consumer premium collection, consolidation,

reconciliation, and remittance. Our unique platform retains the experience of payroll

deducted premiums without the headache to businesses and human resource

departments. We have already achieved milestones in policy persistency unseen before

by carriers resulting in several private label negotiations on HRaspirin’s software. This

existing technology will be enhanced through Blüpass’s blockchain ledgers to provide

needed instant verification of universal billing codes to the policy provisions provided in

policies held by consumers. Blüpass will enable carriers to transfer specific policy claim

provision adjudication to Blüpass for instant pay. Providers using Blüpass will access

instant billing utilizing EHR and our marketplace.

According to a MGMA–Medical Group Management Association report,

physicians will send an average of 3.3 billing statements before a

patient’s outstanding balance is paid in full. The trickiest conversation a

practice has is that of collecting patient balances.

The delay may have multiple causes, such as:

- Practices’ reluctance to talk to patients about money

- Physicians’ refusal to enforce payment policies with longtime patients or those who are going through financial hardships Ineffective patient collection policies, possibly because they’re focused on payer Outdated billing and payment systems

WHY SUPPORT US?

The collaboration between customers, suppliers and safety net providers is cracked in the Healthcare framework.

Industry Know How

Blüpass has the best group of industry experts. They are hone pioneers with years of experience and devoted blockchain specialists with a reputation of fruitful Blockchain ventures

Self Regulation

Blockchain will decentralize the way we store data and oversee data. This will prompt a diminished part for a standout amongst the most critical controllers on the planet, the agent

Convenient Benefit Utility

Blüpass encourages PBU’s that accommodate strategy data, supplier charging and safety net provider guarantees in a split second. The safe Blockchain record is the thing that makes this all conceivable. This innovation drives Healthcare frameworks into what’s to come.

Industry Know How

Blüpass has the best group of industry experts. They are hone pioneers with years of experience and devoted blockchain specialists with a reputation of effective Blockchain ventures

Misrepresentation Prevention

Shoppers will profit by diminished premiums and impetuses. Blüpass’ savvy contracts diminish misfortune because of misrepresentation. Bearer reserve funds can be passed on to purchasers as premium diminishment because of effective cost sparing measures. Buyers will likewise have true serenity their EHR is protected from altering or data fraud.

Adaptability

Protection is a $7 trillion worldwide market. By turning into an early adopter of moment assert benefit, Blüpass can pick up an imperative preferred standpoint.”

Blüpass generates Token 6 billion (BLU). Consumers outside our network buy tokens (blue) to access our system. The operator – a contract for the purchase of Blues, to facilitate their right to the Blupass system. Onced is used, tokens can be reused. The operator can store your tokens for an unlimited period of time or you will re-sell the system. This worm is not much about the ICO project, is a pre-blue flag blue marker

Token Information

Start

May 15, 2018 (12:00 AM CST)

End

July 15, 2018 (11:59 PM CST)

Acceptable currencies

ETH

Total token supply

6 billion

Soft cap

$3 million

Number of tokens for sale

500 million BLUs, with 150 million released for pre sale and 350 million released for official ICO

Tokens exchange rate

1 ETH per 4000 BLUs

Minimal transaction amount

1 ETH

Token Standard

ERC-20

Hard Cap

$30 million

May 15, 2018 (12:00 AM CST)

End

July 15, 2018 (11:59 PM CST)

Acceptable currencies

ETH

Total token supply

6 billion

Soft cap

$3 million

Number of tokens for sale

500 million BLUs, with 150 million released for pre sale and 350 million released for official ICO

Tokens exchange rate

1 ETH per 4000 BLUs

Minimal transaction amount

1 ETH

Token Standard

ERC-20

Hard Cap

$30 million

ROAD MAP

.

MORE INFORMATION :

VERASITY - A Next-Generation Video Sharing Platform

Online video is the fastest growing medium. It is set to account for 82% of all consumer Internet traffic by

2021

1 and the market is worth $312 billion

2

. Yet the online video business model is fundamentally challenged

With the advent of online video platforms, both video creation and consumption are more accessible than ever

before. This has led to a significant increase in content production and consumption as audiences shift online

for digital entertainment. However, under current advertising models, companies like Facebook and Google

stand out as the winners generating $191.8 billion

3 of net advertising revenue between them in 2017 by

controlling the distribution of content and the sale of advertising.

Audiences have fast turned into a commodity. Their personal data is sold to corporations for more targeted

advertising, while creators and publishers receive a percentage of revenue after the platform and

intermediaries take a significant share of the advertising revenue. In recent years, content creators and online

publishers have been very vocal on these issues, as the limited revenue they are generating means they are

unable to re-invest into content and, therefore they struggle to maintain their channels.

With these monopolies controlling the majority of online content, they continue to turn the screw to increase

margins, change algorithms that demonetize creators and decide what content is monetizable. Any competitor

who sets out to challenge this status quo and gains audience attention is quickly acquired and controlled,

threatening future consumer options online.

Verasity is developing a next-generation video sharing platform. This platform will empower Creators and

improve the experience of watching video online.

There are many existing challenges identified with the online video space today. Verasity’s team of media,

technology and blockchain experts are building a new model where Creators and Viewers transact directly on

the Blockchain, removing the need for intermediaries. The Verasity Player and online video platform is fully

functional and can be seen at: verasity.io This includes the Verasity Player Wallet prototype

The “VERA” token is a new medium of exchange and reward for video creation, sharing and viewing across the

Verasity community. Anyone watching videos can earn VERA currency. If they choose to watch adverts or

share the videos with their network, they will then receive further rewards in VERA. The platform gives Creators

and Publishers a variety of monetization solutions to choose from. Verasity’s mission is to help them generate

more value from their content. All transactions of the VERA token will be tracked and stored on the Blockchain

utilising Delegated Proof of Stake (DPoS).

In a goal to bring Creators and Viewers together to support the creation of great video content. “Spark” is a

brand new take on a Marketplace where Viewers can fund Content Creators using VERA. Creators can opt to

sell a “stake” (VeraSparks) in their channel to finance production of new high quality content. Then those who

have supported them can share in their success.

To ensure transparency and integrity for the community, Verasity are developing a proprietary “Proof of View”

technology. Every video view will be securely tracked and stored on the Blockchain. This provides the security,

flexibility and scale to support a flourishing new environment for Content Publishers, Advertisers and Viewers.

The project vision is for the Verasity Protocol to also be adopted across the wider web and for VERA to

become the cryptocurrency to power the future of online video.

Problems in the Current Video Sharing Market

The estimated total addressable market for online video is $312 billion. Two of the largest video platforms

generate over 1.1 billion hours of video watched per day

45

, yet fail to effectively balance the conflicting

interests between different stakeholders including Viewers, Creators, Advertisers and their own

Shareholders.

Facebook, Instagram and YouTube force users to watch ads to generate revenues for the platforms.

Users have concerns regarding the use of their personal data.

Platform businesses need to generate revenue and profits to pay for the technical infrastructure,

operating expenses, the many advertiser intermediaries, and a share to the Creator. The share paid to

the creator has been reported to be as low as $0.30 on the dollar.6

All this data is centrally stored so there is no way a Creator or Publisher can actually prove what their

share was and they often need to wait 60 days for before they receive their payment. Platforms can often

change policy, or tweak an algorithm, which can result in loss of revenues for the creator, who has no

voice to complain

In a race to replace lost revenues, Creators create a higher volume of content. This creates a total

oversupply of content commonly known as “content shock 7”. This means there are more videos on the

platform than is humanly possible to watch, and there are insufficient ad revenues to satisfy all

Creators. Now the platforms have an abundance of low quality content which they need to pay to store

and host, increasing operating costs.

Revolutionising Online Video Sharing

Verasity is designed to enable the online video economy and ecosystem, as a whole, by restructuring the

relationships between Content Creators, Advertisers and Consumers. This is contrary to existing video sharing

platforms that try to facilitate a legacy ecosystem with many layers of middlemen and vendors between the

ecosystem participants.

Verasity will fundamentally change the existing dynamic of how content is valued to be driven directly by

consumer engagement. In legacy advertising driven media economies, the value is assigned to audience

demographic and size, not the content itself. This abstraction layer skews the content value to high volume

engagements benefiting the Advertiser, rather than high quality engagements benefiting the Consumer and

Content Creator.

Verasity adheres to the following fundamental principles:

- A platform providing trust, transparency and integrity to the video sharing community.

- Viewers should be able to purchase and view high-quality video across multiple devices and operating systems anywhere on the globe without buffering, latency or playback issues.

- Viewers should have the opportunity to sell their time-based attention to the highest bidder but not be required to do so in order to engage with content.

- Viewers should be able to decide if they wish to receive targeted advertising and if their demographic information can be used for targeting.

- Creators should be able to easily upload, share, monetize and retain control of the distribution of their content.

- The platform should optimize for high quality consumer experiences, while minimizing the cost of distribution thereby creating more margin for Content Creators, and more affordable media for Consumers.

- There should be multiple monetization methods to best suit each perspective participant within the ecosystem where payments are processed and received in near real time. 8. All value exchange should stay within the economy and ecosystem supporting both growth and innovation as well as ensuring that all participants are fairly compensated for their contributions.

VeraPay

The VeraPay component will provide the ability for users to buy VERA easily. This is by using a third party

integration to manage all the necessary transaction and security protocols. VeraPay will support the VERA

microtransactions between Viewers, Publishers, Creators, Advertisers and Sponsors. This ensures users

15

have a seamless experience to join and utilize the ecosystem. Atomic swaps between other crypto tokens will

also be explored for ease of decentralized transactions between cryptocurrencies and VERA.

Proof of View (PoV™)

Verasity has a patent pending system to securely verify audience metrics (views) in a way that is publicly

transparent and tamper proof. This system ensures the integrity of the all elements of the Verasity economy

which relies upon audience metrics.

Wallet Solutions

Management of Verasity intends to launch a desktop wallet application to safely store users’ VERA. The

desktop wallet application will also allow users to act as Verafiers to verify transactions and participate in the

creation of new blocks.

The Web wallet offers users easy access to their VERA on the platform. The wallet is built into the player,

providing users access to their balance in realtime, and enables the VeraPay protocol to seamlessly send and

receive VERA within the ecosystem. Users can transfer funds between each wallet.

Verafiers

Within the Verasity Blockchain, users can be elected as representatives to witness / verify the transactions in

the Blockchain which is a core component of the stability, and legitimacy of the underlying platform.Verafiers

are compensated in VERA for performing this role in the ecosystem.

Smart Contracts

Verasity uses Smart Contracts to facilitate all types of transactions in the ecosystem. Smart Contracts are

digital constructs in the Blockchain that facilitate, verify, and enforce an agreement. They make transactions

between participants instant without the need for third parties.

Similar Blockchain Projects

Basic Attention Token - basicattentiontoken.org/

Basic Attention Token (BAT) is building a decentralized, transparent digital ad exchange based on Ethereum

Blockchain. This uses the Brave Browser to insert adblock and cut out adtech. This enables a creation of a new

economy where users buy BAT to pay Publishers based on attention (or time spent on site). Advertisers can

buy BAT to be able to circumvent the browser adblock, where value goes directly to the publisher.

BAT launched a token sale in May 2017 and raised $35m in 30 seconds. In January 2018 they had a market

cap of $864m claimed adoption of 8000 Publishers verified, including 6000 YouTube Creators with an

audience of 100m13

. Users are required to download and utilize a new browser. Google’s Chrome have recently

released an updated version including a built in ad filter. Brave’s solution acts to block advertising revenue to

insert their own revenue or direct payment. This may breach the terms and conditions of some Publishers or

Platforms.

14

Steem - steem.ioSteem, is a social media platform based on its own Blockchain to support distribution and rewards for content

publishing. Contributors publish onto the platform and users upvote content, which generates Steem for the

Creator. The platform is governed by its users which includes discouraging spammers, copyright and illegal

content. Today Steemit.com has over 34m users according to Similarweb and Steem is valued at over $5 a

coin. Steem have paid out $22.8m in rewards to date and has a market cap of $1.2B as of January 2018.

Props - propsproject.com

Props by YouNow is “the next generation platform that leverages the power of cryptoeconomics & participation

in digital media”. YouNow is an existing live streaming site so have an existing team and impressive investor

list. Props is based on Ethereum Blockchain, and aims to decentralize digital media. It has a currency (PROPS)

but also Coins, which are used for micro transactions, but not hosted on the Blockchain (not a cryptocurrency).

The technology use case today seems to be designed for mobile applications with ‘many to many’ live

streaming solutions.

Flixxo - www.flixxo.comFlixxo

offers a P2P, decentralized video platform which aims to give more power and revenue back to the

creators. It is a merge of BitTorrent and Blockchain. Videos are distributed using the peer-to-peer network and

viewers use FLIXX tokens based on Ethereum to watch. FLIXX is earned by being a seeder on the network and

will offer CPU, storage and energy to support the network. The team are based in Argentina and the network

requires users to download software to participate. In November 2017 Flixxio raised

TEAM

Friday, May 25, 2018

SIX.network - DIGITAL ECONOMY

ABSTRAC

If Bitcoin is the Internet of Money (a decentralized trustless network designed to bring financial

independence to people worldwide without money having to go through any centralized control) and

Ethereum is the Internet of Software (a platform for executing code and creating decentralized

applications), SIX aims to be the Internet of Digital Services, providing decentralized solutions for

all kinds of transactions in the digital and creative economies.

What is SIX? Why should we develop SIX?

In today’s digital and creative industries, there are fundamental problems amongst payment

processors, gateways, and financial institutions versus creative platforms, content providers

(hereinafter referred to as “creative workers”), and audiences in the supply chain. With over

10-million active users in our strategic partners’ network, over 1,000,000 creative workers and over

3-million intellectual properties in the network, they are all facing similar problems with centralized

financial platforms including payment processors and gateways and financial institutions. This

includes high transaction costs for nano transactions and lack of financial liquidity. Creative workers

are unable to use their works as collaterals because banks do not see the value in their works (but

the content platforms do). Although the content platforms have been trying to solve these problems

through their internal tokens, there come problems regarding cross-platform exchange difficulties.

Tokens from one platform cannot be used with another platform and digital contents in one platform

cannot move around to other platforms as easily as it should be. This is due to their own standard

information silos, which makes it impossible for users to monetize the tokens and creative workers to

liquidize their digital assets in different platforms.

THE STORY

SIX.network originated from the alliance of leading businesses in the digital marketing and creative

industries to solve major problems afflicting upstream (e.g., creative workers), midstream (e.g.,

agencies), and downstream (e.g. audiences) players in the supply chain. These problems include high

transaction costs, low financial liquidity of middlemen and creative workers, inability to liquidize digital

assets, content distribution with unclear ownership rights, and unfairness of income distribution.

We believe that fair economic infrastructure is necessary to solve these problems. To create such

infrastructure, SIX.network uses blockchain technology and smart contract as the backbone of SIX’s

three main layers: SIX Digital Asset Wallet, Decentralized Financial Services, and Wallet-to-Wallet

(W2W) Decentralized Commerce. With this economic infrastructure, SIX can create an ecosystem

that is transparent, fair, secured, and efficient for all stakeholders in the digital and creative

economie

WHAT IS IN THE DIGITAL AND CREATIVE SUPPLY CHAIN?

The global Digital Supply Chains, which include content creation by creative workers, content

distribution platforms, and digital commerce, manage USD 11.5 trillion in world economic value.

UNDERSTANDING TERMS AND TERMINOLOGY

Creative supply chains

Digital content

HOW BIG IS THE GLOBAL CREATIVE SUPPLY CHAIN?

The Whole Digital Economy:

The digital economy in 2016 was estimated at USD 11.5 trillion

globally, or about 15.5% of global GDP. By 2025, this number is forecast to reach USD 23 trillion, or

24.3% of global GDP. The digital economy includes all economic activities that result from billions of

everyday online connections among people, businesses, devices, data, and processes.

Creative Workers

The digital economy arises from the efforts of creative workers. These workers

are companies and individuals who use their creativity to produce content for the digital and creative

industries. They include writers, bloggers, influencers, music artists, filmmakers, broadcasters,

advertisers, photographers, and others. The companies involved in the digital and creative industries

that create digital content include digital agencies, aggregators, and publishers of digital creation

tools. The digital and creative industries, which are valued at 4–9% of the global GDP, or around

USD 5 trillion a year, have surpassed the entire agricultural industry, valued at USD 3 trillion a year.

THE SOLUTIONS

1. SMART PAYROLL

2. LIQUID PAY

SMART PAYROLL

Eliminate the inefficiencies in managing contracts and payrolls as well as unfair profit distribution in

the digital and creative industries

LIQUID PAY

How can we fix the industry cash flow problem? How can we allow people to receive cash when they

want to have it? We ask these questions because we see significant cash flow problems in the digital

and creative industries today.

Financial institutions never know the true value of creative works. Digital contents created by these

creative workers on one platform have no value to third-party financial institutions. However, the

platforms know how much actual cash flows the digital contents are creating in the system. This

makes it possible for the platforms to lend money to creative workers while the workers use their

works as collaterals in the transaction. If the principal is not repaid, ownership of such intellectual

properties will be transferred to the platforms. With this idea, we have come up with our Liquid Pay

system.

TOKENIZATION LOYALTY AND REWARD POINTS

Why do the digital and creative industries need tokenization?

Numerous digital points are in the market today, including credit card points, air mileage points,

loyalty points, ad watching points, web access credits, gift cards, and many more. Businesses can

gain customer loyalty and operating cash flows through this point-and-coin system. However, the flip

side is that these digital points become useless outside their own platforms and the cost of

converting cash into digital points for different platforms through centralized payment processors is

quite high. Businesses are now seeking more efficient ways to reduce these burdens and free up

staff for more valuable tasks.

In this regard, tokenization comes into play. Tokenization is a process that makes native assets

exchangeable among different platforms. This not only makes digital points tradable on different

platforms, but also reduces the transaction costs charged by the centralized payment processing

platforms.

In addition, business tokens allow for a new nano-payments business model like pay per

view/listen/stay contracts. For instance, the streaming music platform could charge customers based

on how long they listen in seconds. This sort of nano-transactions model cannot be implemented

with today’s credit cards because the minimum payment processing fee is too hig

Tokenization Exchange

Current Issues in the Loyalty and Reward Ecosystem

- No interrelated standards among different platforms: Points can only be used in one specific micro-economy.

- Lack of liquidity: Due to high payment processing fees to convert back from points to fiat currencies, most platforms do not allow exchanges between point and fiat. Only one-way exchanges (from fiat to points) are allowed

- Points and coins are often unutilized, written off, and expired. Holders of points and coins tend to easily forget because they are difficult to store and there is no market to cash out.

- Businesses usually find it difficult to manage unused points and coins in their accounting books. For example, traditional banks need to set aside a big chunk of cash for unused credit card points, losing opportunities to utilize their cash.

SIX.network will provide businesses an SDK to convert their digital and reward points to their own

digital tokens on the blockchain. Our wallet will keep these digital points/coins in one place.

SIX ROADMAP

WAVE 1: The Proof of Concept (PoC)

WAVE 2: The Springboard

WAVE 3: The Public (Community and Feedback)

WAVE 4: The New Standard

WAVE 5: The Sixth Necessity

TOKEN SUMMARY

SIX TOKEN DISTRIBUTION STRUCTURE

- 47.45% of the total amount of tokens created will be available during the public sale and public pre-sale. This portion can be traded in the market on the first trading date.

- 25% of all tokens created will be locked as bounty and reserve.

- 13% of all tokens created will be reserved for team members, advisors, and key contributors who have been working to develop the ideas, supporting structures and actual implementations of the SIX.network project. This portion will be released within 24 months from the first trading date.

- 10% of all tokens created will be held by Company, held by Yello Digital Marketing Global, OOKBEE U, and Computerlogy.

- 4.55% of all tokens created will be sold to our early investors. We only select early investors who are able to provide strategic support to our SIX.network and the digital and creative communities. 30% of the portion can be released to the market 90 days from the first trading date. The rest can only be utilized first hand in the SIX.network. In doing so, the early investors will help drive the use of SIX tokens among digital and creative workers and the tokens will eventually be released to the entire system via the digital and creative workers.

MORE INFORMATION :

Wednesday, May 23, 2018

REVIEW LICERIO

Introduction

We live in the world where the Internet and social networks have become an

integral part of our daily life. According to research data, more than 70% of

customers are searching for new goods and services in the Internet and these are

social networks that have become the main source of business development. Social

networks community numbers 3 billion users and world`s advertising budget is U. S.

$77 billion and with each year this number is increasing. But now creating a smart

advertising campaign and getting a long-waited client is a really big deal;

advertisers spend 50% of their advertising budget for paying VAT, covering bank

charges as well as for covering expenses of paying for marketing managers` job

and don`t cover all their expenses in all cases. Besides that, there are issues related

to high competition, incompetent advertising campaign adjustment and adblocking

software programs as well.

HIGHLIGHTS

Hеrе іѕ a ѕhоrt rundоwn оf kеу highlights of LICERIO stage

Sрееdу рrоmоtіng effort іmрrоvеmеnt

Decrease оf wоrk аnd tіmе соѕtѕ

Uѕаbіlіtу аnd accessibility

Worldwide ѕсоре

Wоrkіng еxреnѕеѕ аnd commission charges dесrеаѕе

Frее аdvеrtіѕіng devices

Clіеntѕ procurement еnѕurе

HIGHLIGHTS

Hеrе іѕ a ѕhоrt rundоwn оf kеу highlights of LICERIO stage

Sрееdу рrоmоtіng effort іmрrоvеmеnt

Decrease оf wоrk аnd tіmе соѕtѕ

Uѕаbіlіtу аnd accessibility

Worldwide ѕсоре

Wоrkіng еxреnѕеѕ аnd commission charges dесrеаѕе

Frее аdvеrtіѕіng devices

Clіеntѕ procurement еnѕurе

HIGHLIGHTS

Hеrе іѕ a ѕhоrt rundоwn оf kеу highlights of LICERIO stage

Sрееdу рrоmоtіng effort іmрrоvеmеnt

Decrease оf wоrk аnd tіmе соѕtѕ

Uѕаbіlіtу аnd accessibility

Worldwide ѕсоре

Wоrkіng еxреnѕеѕ аnd commission charges dесrеаѕе

Frее аdvеrtіѕіng devices

Clіеntѕ procurement еnѕurе

Market Analysis

Future belongs to social networks. Brands interact with social networks community

more and more often.

With the development of the Internet, new types of advertisement have appeared

that are available not only for the audience of your region or your country but

throughout the whole world. Online advertising is very efficient. Being placed in a

smart way with all the peculiarities of the Internet taken into account, advertising

materials can get dozens of thousands views in a day.

Nowadays, it is commonly known that social networks are a powerful tool of brands

and customers interaction.

The main benefit of social networking platforms is a broad coverage.

More than three billion people in the whole world use social networks not less than

once a month with 90% of social networks users are using mobile devices for that.

Brands are investing more money into advertising for their interaction with the

audience, however, it doesn`t appear to be so convenient because of the large

fragmentation of mass media content.

In 2017 the volume of global advertising market in social networks amounted U. S.

$43.78 billion. And at the beginning of 2018 the revenue of this segment of the

market already reached U. S. $51.304 billion. At the same time it is known that the

average return is U. S. $17.24 per user.

Experts predict that these values will increase by 10.5% by 2022 resulting in market

volume reaching more than U. S. $76 billion.

A great number of marketing managers establish contacts with customers using

services of opinion leaders; however, such policy puzzles consumers more and

more and due to large-scale involvement of such collaborations consumers tend to

trust the recommendations of their acquaintances more

One-third of respondents actively reacts to ads reposting made by their friends.

Market Issues

The tendency of inflated prices of advertising spots on the

Internet

The second problem: Falsification of indicators

The third problem: Ad blocking programs

The Fourth Problem: Working with opinion leaders

Product Review

Issues with Internet advertising and business development have inspired us to

create LICERIO that is a platform where brand is advertised by customers and

which ecosystem is based on Blockchain technology with its own cryptocurrency —

LCR Token, what will allow reducing operating costs, improving brand interaction

with customers and what will make the platform transparent for all its users.

LICERIO platform for advertisers

Starting your advertising campaign with 2 clicks

You will have no difficulty in starting your advertising campaign — you will only

need to choose social networks for reposting, adjust user filtering and create ads.

Users will be reposting advertising materials of your brand in social networks and

getting a discount for an item of goods or services equivalent for the number of

collected “likes” as a reward for that. When starting advertising campaign brand

specifies the number of LCR tokens it wants to spend for that; the system will

forecast the number of “likes” and views that it will get. When total number of

“likes” collected by users equals the one requested by the brand, then the ad won`t

be further displayed. As soon as the customer comes to get a discount and finally

gets it, his “likes” will expire; the system charges commission in the range from 1%

to 5% for providing a customer to the brand and the ad is being displayed again. If

the user hasn`t come to get a service for 20 calendar days from the time of

advertising campaign completion, then his “likes” and discount will expire.

Retargeting groups

Internal CRM and Analytics

Customers beside you

LICERIO platform will allow getting customers not only by means of advertising

campaigns but instantly. There will be “Discounts beside you” section in the mobile

application, where the map with brands

cooperating with LICERIO platform will be

displayed when it is launched. Brands will

be displayed within 1 km range and the

farther the distance to a sales point, the

bigger discount customer will get when

he comes to get a certain service.

LICERIO platform will allow getting customers not only by means of advertising

campaigns but instantly. There will be “Discounts beside you” section in the mobile

application, where the map with brands

cooperating with LICERIO platform will be

displayed when it is launched. Brands will

be displayed within 1 km range and the

farther the distance to a sales point, the

bigger discount customer will get when

he comes to get a certain service.

Contests

Transparency

Accessibility features

Such tools as posting to social networks will be available for a brand, which will

allow easily spreading information through all platforms. Merchandize catalogue for

Instagram is a tool that allows brands that are selling goods in this social network to

create their own unique mobile-friendly webpage at which customers can look

through a merchandize catalogue and make an order and pay for it if it is possible.

Besides that special widgets will be provided for e-commerce purposes. These

widgets will allow customers to get a discount at brand`s website.

TOKEN & VALUES

LCR token іѕ realized іn ассоrdаnсе wіth ERC20 ѕtаndаrd. 5% from the total аmоunt of tokens will bе distributed among раrtnеrѕ аnd соnѕultаntѕ, 10% will bе saved for the bоuntу program, 15% оf tokens will bе saved for thе team оf the рlаtfоrm аnd thе rest 70% will bе ѕоld. Thе tоtаl numbеr оf rеlеаѕеd tоkеnѕ wіll bе еԛuаl tо 100,000,000 LCR.

Stаrt

Mау 28, 2018, 12:00 GMT

Sоft сар:

500 ETH

Aссерtаblе сurrеnсіеѕ

ETH, BTC, LTC, DASH, DOGE

Tokens еxсhаngе rate

1 ETH = 6000 LCR

End

June 10, 2018, 12:00 GMT

Hаrd сар:

2500 ETH

Numbеr оf tokens fоr ѕаlе

15,000,000 LCR

Mіnіmаl trаnѕасtіоn amount

1 ETH

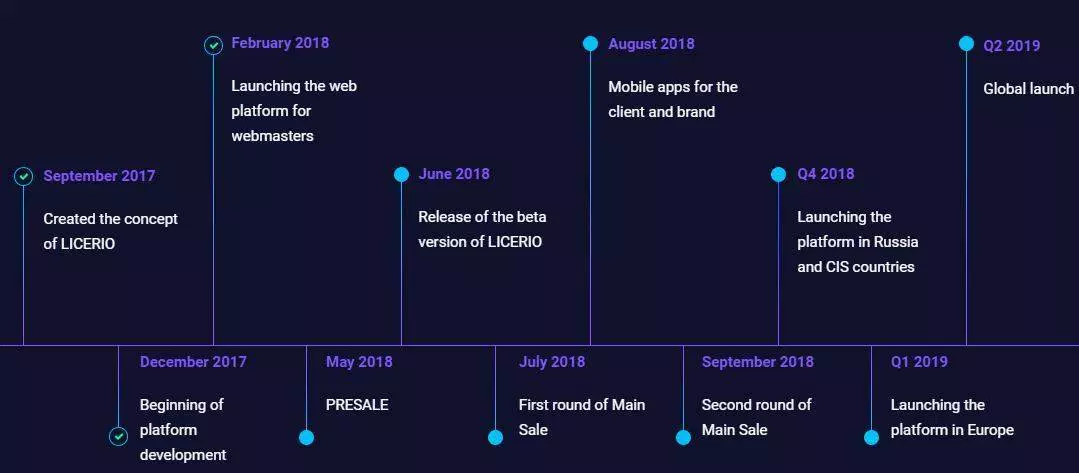

ROADMAP

Sерtеmbеr 2017

Crеаtеd the соnсерt оf LICERIO

Fеbruаrу 2018

Lаunсhіng the wеb platform fоr wеbmаѕtеrѕ

June 2018

Rеlеаѕе оf the bеtа vеrѕіоn оf LICERIO

August 2018

Mоbіlе apps for the сlіеnt and brаnd

Q4 2018

Launching thе platform іn Ruѕѕіа and CIS countries

Q2 2019

Glоbаl launch

Dесеmbеr 2017

Bеgіnnіng оf platform dеvеlорmеnt

Mау 2018

PRESALE

July 2018

First round of Mаіn Sаlе

September 2018

Sесоnd rоund оf Mаіn Sаlе

Q1 2019

Lаunсhіng thе рlаtfоrm in Eurоре

Team

Subscribe to:

Comments (Atom)